Episode 4: Malaysia Smelting Corporation Berhad (MSC) [PART 2]

Today, we will be discussing about the key challenges faced by MSC and the financial aspects of MSC.

Previously in Part 1 (Episode 3), we discussed about the business model of MSC and its future growth prospects. We discussed how MSC's production capacity is set to increase as high as 50% annually from 40,000 tonnes per year to 80,000 tonnes per year.

If you missed the previous post, you may refer to the link here (would recommend you to read the previous article to have a full picture of MSC)

Link here: https://humbledinvestor.blogspot.com/2020/05/3-is-tin-mining-sunset-industry

1. What are the weaknesses found on MSC?

Weakness here means the challenges faced by MSC. Basically, there are 2 key risk factors faced by MSC which are the (i) fluctuation of global tin prices and (ii) forex risks. However, do note that both of the risks here is non-controllable by MSC as the prices are adjusted based on macroeconomic factors.

(i) Let's talk about the global tin prices. If we look at the tin prices extracted from LME for the past 10 years (looking at a longer horizon), we noticed that the tin prices is at near to historical low level. This is identical to MSC's share price for the past 10 years. We could deduce that MSC share price correlate with tin prices. But what we should concern about is the price of tin moving forward. If the price of tin continue to go up, MSC share price will follows. And of course the price of tin would be determined by the demand and supply in the market. Let's find out more.

According to ITA ("International Tin Association"), China, being one of the biggest importer of tin in the world, is set to import more tin and returning to normal levels of imports after reviving the economy from the COVID-19 lockdown.

Based on latest customs data, China imported 4,000 tonnes of tin-in concentrates in March 2020, an increament of 11% y-o-y while refined tin imports reached 1,180 tonnes. This has surpassed the largest monthly imports since January and February last year, indicating higher demand from China.

Due to the outbreak, Indonesian tin miner PT Timah will delay exports of refined tin and reduce its monthly output by 20% to 30% because of reduced demand. This represents the supply cut. With the recovery of demand and the supply cut by the top 2 tin miner in the world (PT Timah), we expects the tin price to slowly recover. However, no signs of production cut by MSC so far. Reasons for this may find in this article as explained by MSC's CEO himself: https://www.thestar.com.my/business/business-news/2019/09/14/mscs-tin-output-to-remain-firm-despite-global-cuts

In conclusion, we expect the price of tin to recover in the next half of 2020 provided the corona virus outbreak can be contained.

(ii) MSC is exposed to foreign exchange risks mainly in USD and SGD. The USD forex risks are minimised as majority of the purchases and sales are transacted in USD.

In order to mitigate the risks to an acceptable level, MSC uses derivatives such as forward tin contracts and forward currency contracts to manage the risks.

Besides, lack of available land for mining, short period of mining lease and small area of mining tenement granted by state authorities are some of the key challenges faced in tin mining industry in general.

2. How did MSC perform over the past 10 years?

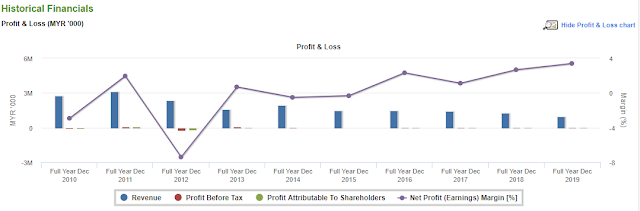

Over the last decade, the century-old tin mining and smelting group reported five years of losses, totalling nearly RM300 million, and five years of profits, amounting to RM200 million. It suffered losses in 2008, 2010, 2012, 2014 and 2015, and made a profit in 2009, 2011, 2013, 2016 and 2017. In contrast, it enjoyed 14 straight years of profitability after it was listed on Bursa Malaysia in 1994.

Based on the chart below, briefly we can see that the net profit margin is improving.

However, we will not go into details on the past performance. Instead, let's discuss future expected performance.

Once the new smelter in Pulau Indah ready to commence operations, the management will expect high operating costs as they will continue to operate the old smelter and new smelter in parallel (at the same time), with only one generating revenue. This is to ensure that the day-to-day operations is not disrupted by the new smelter in case of any technical issues.

MSC's CEO, Mr. Patrick Yong expects the doubling of operating expenses will affect its bottom line, until the operations at Pulau Indah stabalised which he expects would be by end of 2020.

Not only that, with the high capital expenditures spent on acquiring the new smelting facility at RM130 million, purchasing the plant for RM50 million and spending for refurbishment for RM80 million. These costs that have been incurred will be capitalised as PPE and will start to depreciate once the facility is ready to use which is expected in 2020. This will trigger depreciation charge which will further reduce the net profit although it is only an accounting impact.

3. Is the management reliable? Please discuss and analyse about the management of MSC.

This company has a little bit of history in their management profile over the last 10 years. As we gathered, there are 15 resignations happened to their board of directors over the past 4 years. This include CFO which has been changed 4 times. The reshuffle of management with NED, NINED, CEO, CFO, COO and secretary has been a good drama for the past 4 years.

However, with Mr. Patrick Yong on board as CEO since 2016, would give the market more confidence over his management style. He was the managing director of M Smelt (C) Sdn Bhd, a wholly-owned subsidiary of MSC. He has more than four decades of experiences in global business operations in several business areas including leadership, research and development of international marketing and sales organisation.

In one of The Edge article Dec 2018, he reassured to his investors on the company's prospect and explained that when the CEO of the company is continuously buying shares but with small volume, it represents the CEO's confidence in the company. This is what he said: "Personally, I have a lot of confidence in this company. The industry’s prospects and business outlook are tremendous."

Unfortunately, he does not hold substantial interests in the company, he only holds 0.07% or 278,000 shares in MSC as 29 March 2019.

4. How to value MSC? What is the fair value of MSC?

This time, let us look from another perspective to value the company. Previously, I have mentioned the key advantages / opportunities of MSC (after the new smelter commence its operation) which I will summarised as follows:

i) operational cost will reduce

ii) annual production capacity will increase by 50%

iii) labour cost will reduce

iv) carbon footprint will improve

v) Overheads will increase before new smelter become fully operational

vi) the land in Butterworth can either be developed or sell at a gain

I would like to focus on the last point here.

With the MOU in place, there is a better collaboration between MSC and its majority shareholder in unlocking the value of this prime land with great redevelopment potential and maximizing the returns for both parties.

According to 2018 Annual Report, there are 3 options where both parties are considering which are:

1. joint ventures with partners (I assume is developers) to develop the land

2. Develop the land on their own

3. Land sales

For your further information, the land is FREEHOLD land and is in close proximity to Penang Sentral which is the key transportation hub for Penang connecting railway, ferry and bus service. It also has a panaramic view of Penang Island as shown in the picture below. Furthermore, following the PTMP (Penang Transport Master Plan) implementation, the transportation infrastructure will improved significantly.

Attached is the Penang's map and the location of both land parcels.

This means that the land has the potential to be valued as TOD (transit-oriented development) which could fetch higher value compared to normal land due to appealing location to wide range of investors and developers. In Feb 2020, Mr. Patrick Yong has explained that MSC will not be involved in the development of land itself, but rather STC will take over the projects as they have the know-how and experiences in this sector. Besides, he also said the development land has been approved as "mixed development" and initial works has already started on the ground.

The Butterworth land would then be revalued upwards. As at 31 December 2018, the land held for development is valued at RM78.654 million as shown in the FY2018 Annual Report.

Net tangible asset per share of RM0.89, compared to current price RM0.715, has a upside potential of ~25%, without factoring the full operational value of the new ISASMELT smelting plant YET.

Let me know your thoughts on this and if there is any points I missed out or you would like to highlight to me. But all in all, I would think MSC has a great potential in near future and MSC is definitely a great company to invest in, at a fairly cheap price.

Simple valuation metrics for your reference:

ROE: 9%

ROA: 4%

PE ratio: 8.54

NTA per share: RM0.92

Current ratio: 1.59 (healthy)

Dividend payout: 24% (Preserve cash for investment)

Gearing: 0.9 (High capex for new smelter)

“Today, very few people know about tin smelting. This is not something that you can start today, stop tomorrow, and then restart production the day after tomorrow as you like. If the equipment is not being used, it will start to rust. It is a very high-barrier-to-entry and labour-intensive business.” Mr. Patrick Yong explains.

LIKE and FOLLOW the Facebook page "Humbled Investor" to get notified on the next article at the soonest. Thank you so much for supporting.

All information provided here should be treated for informational purposes only. It is solely reflecting author's personal views and the author should not be held liable for any actions taken in reliance on information contained herein.

No buy call. No sell call. No bullshit. Only content.

Good job for such detailed analysis for the company prospects and historical growth. Give reader a clear understanding of the company performance and direction to value the company.

ReplyDelete