Episode 5: Mi Technovation Berhad (Mi)

Malaysian semiconductor companies are

involved in the mid to lower end of the value chain, serving foreign

semiconductor manufacturers, brand owners, integrated circuit developers and

fabricators. They can be divided into three groups.

The first group comprises OSAT companies

such as Unisem,

Globetronics, Inari Amertron and

MPI, which mainly provide outsourced services, including assembly, packaging,

fabrication and testing.

The second group consists of ATE

manufacturers like ViTrox, Elsoft, Aemulus,

MMSV, VisDynamics and Pentamaster,

which serve the OSAT companies and other multinational semiconductor

manufacturers.

The third group comprises the likes of JF

Technology and FoundPac,

which design and manufacture high-performance test sockets and other materials

for OSAT companies and semiconductor firms.

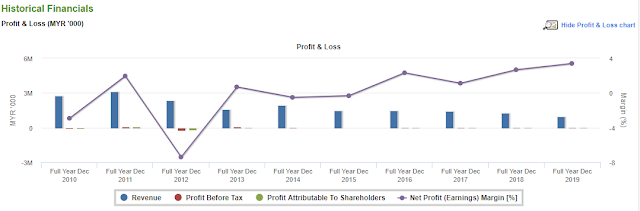

Today, we will be discussing about the rising star as an ATE manufacturer - Mi Technovation Berhad (Mi). Mi involves in designs, develops, manufactures, and sells wafer level chip scale packaging (WLCSP) sorting machines for the semiconductor industry. Its primary product is the Mi series WLCSP sorting machine used for die sorting from wafer to carrier tape for bare die, bump/flip chips, and WLCSP.

Why I did not invest in Mi Tech in 2019?

1. Recurrence of revenue

Back then when I analysed Mi in July 2019, I noticed that there is no recurrence of revenue. If we look at the revenue breakdown by customers, 2 customers who contribute more than 10% of revenue in 2019 are completely 2 different customers compared to the other 2 customers in 2018 and 2017 respectively.

However, I realised that Mi's customers do not incur capex as often as every year to replace the equipment. Therefore, the bigger the customer base acquired, the higher

the sales considering that the customers will not buy their equipment every

quarter.

As at the end of 2019, Mi have approximately 53 active customers, comprising OSATs and IDMs, which their five largest customers accounted for 59.5% of total revenue in 2019. Despite ongoing trade tensions which cause delays in capex investment decisions, sales momentum managed to pick up in the second quarter of 2019 onwards owing

to strong demand from customers in Taiwan and China as a result of the growth in capital investments from certain

OSATs in advanced/wafer level chip scale packaging.

2. Tax holiday ended in January 2019

In FY2018, the effective tax rate was 0.3% as the new equipment products were entitled to tax holidays under the pioneer status incentive. However, the tax incentive was going to expire in January 2019, subject to further renewal of five years. As there is no certainty on getting the renewal for tax incentive, I have a second doubt on investing in this company.

Fortunately, Mi Equipment has successfully renewed its pioneer status for a further 5 years from 18 January 2019 to 17 January 2024. The tax incentive is beneficial to the company for the next 4 years as the effective tax rate would remain low. However, this only applies to Mi Equipment Sdn Bhd. Given that Mi Autobotics is expected to contribute 15% to 20% of total revenue in FY2020 from its operation in Batu Kawan plant, the taxation charge might increase and lower down the bottom line.

3. Depreciation will commence when PPE is ready for use

Once the factory building in Batu Kawan and Bayan Lepas start operation, I know that the factory building will start to depreciate. Depreciation will hurt the accounting profit quite significant in future despite it being a non-cash item.

However, depreciation can also be viewed as the return on asset. The ability of a company to generate higher returns than the depreciation rate, the company is said to be earning a decent rate of return from the assets owned.

Mi's Competitive Advantages

1. High margin business

Mi has maintained a gross profit margin of more than 45% and net profit margin of ~ 30%. This is due to continuing innovation of products by the company. With the new engineering centre in Taiwan and Korea ready to operate by mid 2020, R&D is expected to double up to RM2 million as indicated by Management. As Mi's products are all exposed to technological obsolescence, R&D is unavoidable.

By venturing into advance automation and robotic solution with AI, new launched products such as Oto and Kobot series are expected to bring in new source of income for Mi and their respective margin is expected to be high as well given the high technology embeded in their products.

2. Increased Production Capacity

Production capacity in Bayan Lepas will increase by 4 times and the machines manufactured will increase from 12 machines per month to maximum of 45 machines per month.

Batu Kawan plant has been completed in Feb 2020 and is expected to commence operation in second quarter of 2020.

3. Strengthening USD beneficiary

Given that MYR will continue to be weaken with the political uncertainty, Mi has an advantage as most of the sales are transacted in USD. Approximately 93% of our revenue are denominated in USD while their costs are mostly denominated in MYR (64%) and USD (17%).

4. Good management

Interestingly, Group CEO and CFO are husband and wife, and Mr. Oh holds a significant stake in the company at 68% as at 9 April 2020. Therefore, the interest of management is said to be align with the shareholders. Besides, the dividend payout is relatively high at 56% and 46% (FY2018 and FY2019) as compared to the dividend payout ratio of a fast growing company that I would imagine.

Pandemic impact and what's going forward

In 1Q2020, revenue has reduced by 48% and gross profit margin reduced to 40% due to higher material costs. Higher headcount costs and higher depreciation charge has also resulted in reduction of net profit margin.

Due to MCO, the company is operating at 25% from 1 April to 20 April, 50% from 21 April to 3 May with full operation from 4 May onwards. Although Management represented that there is no significant reduction or deferment in orders, there is little visibility going forward as their customers are adopting a wait-and-see approach and their order visibility is only up to 6 weeks.

At the bright side, Mi is in the right industry trend and the long term outlook is fairly positive given the adoption of technology based hardware and higher usage of chips from demand for medical devices and disinfectors.

In addition, Oto series (specialised AI enabled machines) produced by Mi Autobotics has received 2 orders from US. Going forward, Management expects the sales momentum for AI machines such as Oto and Kobot series to continue as more factories require installation of automation solutions and more companies heading towards the adoption of Industry 4.0 due to pandemic.

New product - Engeye series is in the final development stage. It is expected to be sell to healthcare, hospitality, education and manufacturing industries. This is align with the company's motive to reduce the reliance on semiconductor industry and diversify to other industries to stay competitive and be sustainable in the long run.

All in all, Mi is a great business in the right industry. But in terms of valuation with the current PE ratio of 29, it is considered fair value compared to peers. With ROIC of 17.6% and net cash position, the company is fundamentally sound and any fall in share price is worth investing for medium term.

_________________________________________________________

All information provided here should be treated for informational purposes only. It is solely reflecting author's personal views and the author should not be held liable for any actions taken in reliance on information contained herein.

No buy call. No sell call. No bullshit. Only content.

If you think the article / information is useful to you, you can <SHARE> this article and support us by <LIKE> and <FOLLOW> our Facebook page "Humbled Investor". Thank you so much for supporting.😁